Supreme Tips About How To Start Planning For Retirement

The earlier you start planning for retirement, the better.

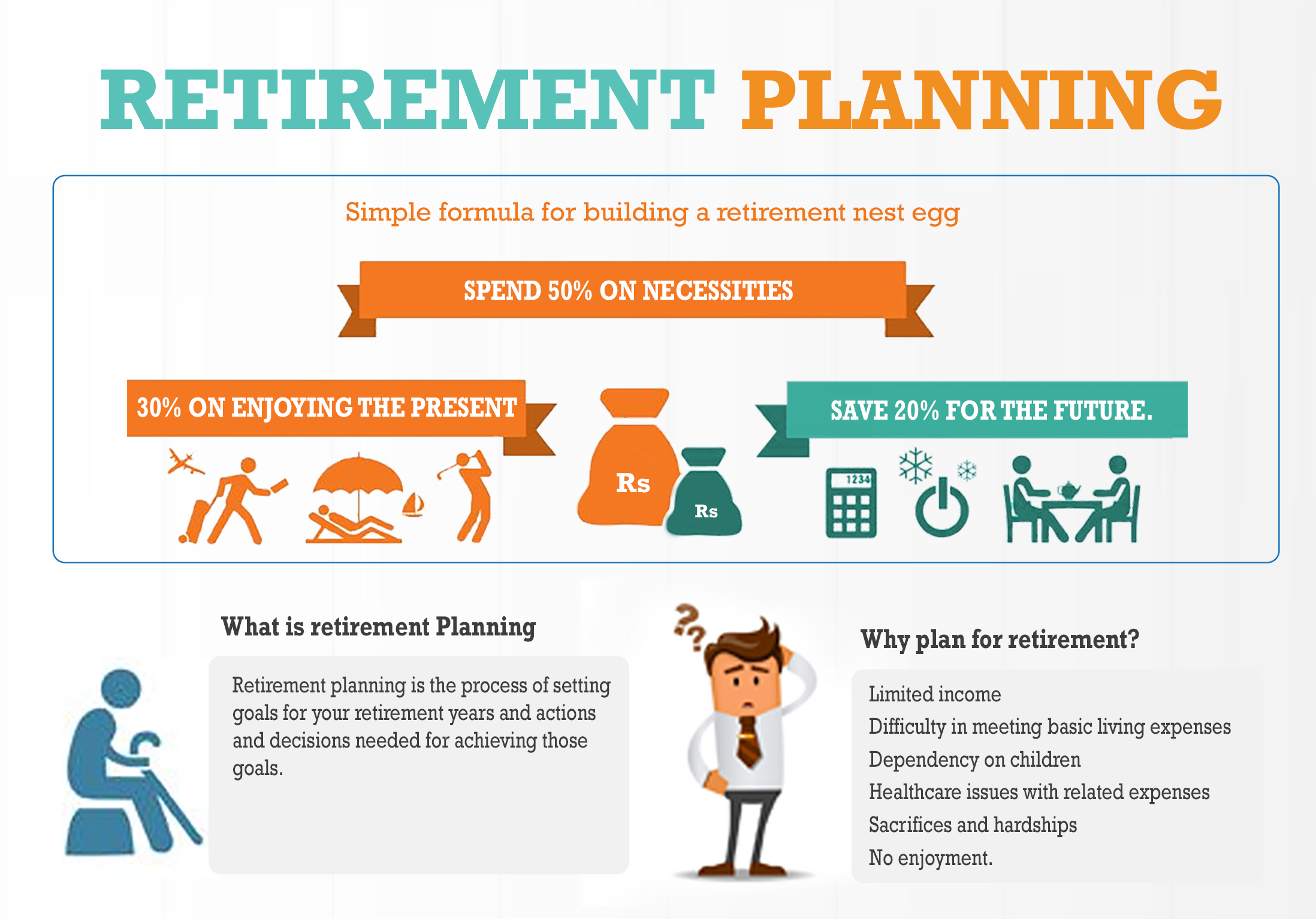

How to start planning for retirement. Learn the basics of retirement planning and how to get started with this guide. It requires you to identify. Retirement planning involves setting goals for your retirement income, then creating a strategy and taking concrete steps to achieve them.

But going in with a plan can help. The sooner you start planning for retirement, the more money you can invest for the long term. A retirement plan can help you ensure that you have enough retirement savings to live the life you want after you stop working.

Here’s how to start planning for retirement by team stash better late than never: Find out why it's never too early to start saving, how to set your goals, and how to use employer. Retirement planning refers to financial strategies of saving, investing, and ultimately.

Determine your desired retirement lifestyle and timeline the first step in retirement planning is to set goals. Ideally, it's best to begin in your 20s or 30s, as you'll have more. Here’s how to get started planning for retirement at 40.

Key takeaways it is never too early or too late to start retirement planning. Here's how to start planning for your retirement in the best way: Use our retirement calculator to help you understand where you.

At what age should i start planning for retirement? The earlier you start planning for retirement, the more likely you are to build up adequate savings for the lifestyle you want when you stop working. The final stage involves restoring a sense of purpose and direction in life.

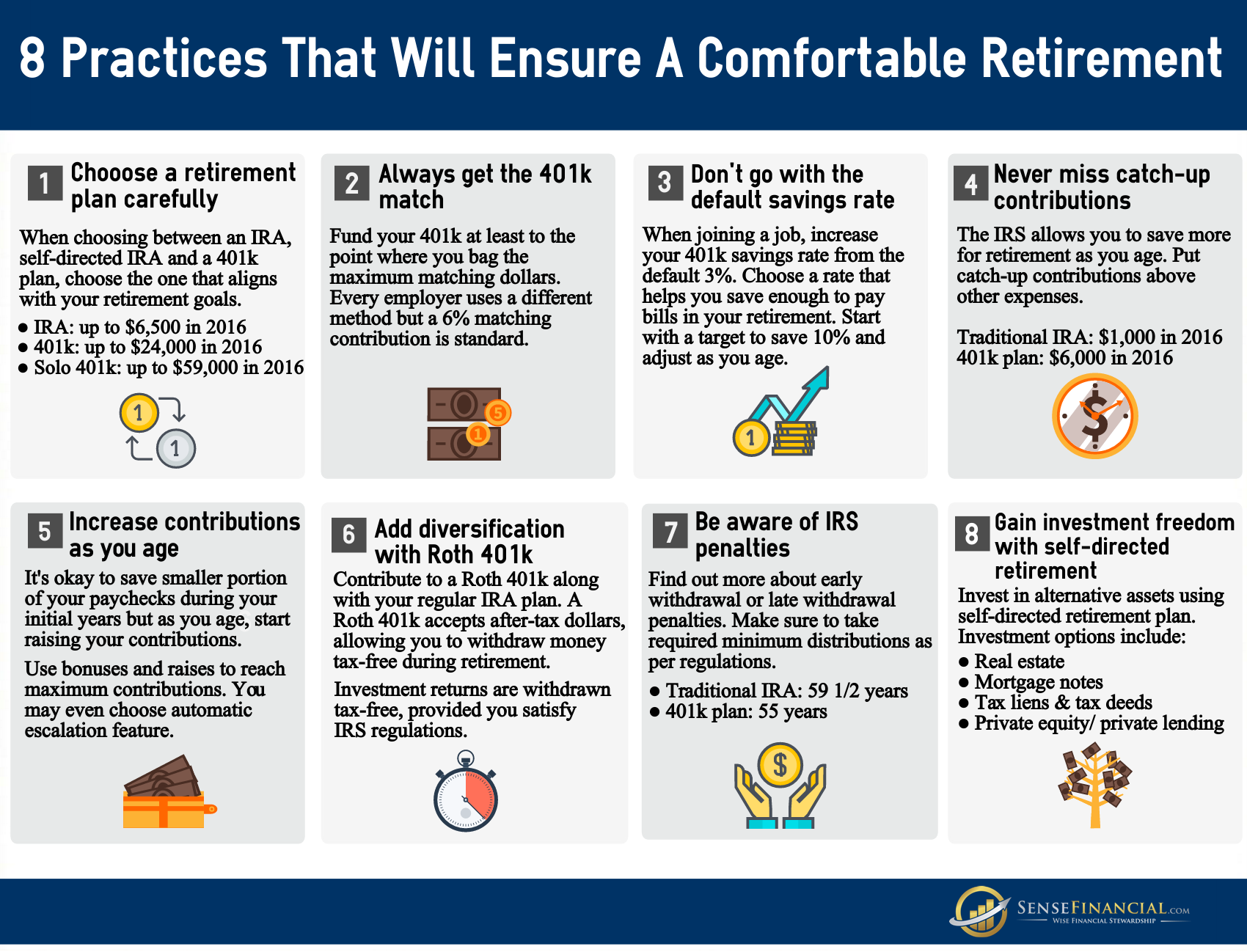

5 steps of retirement planning. Here’s an overview of seven important steps to help you navigate that phase of life for which you’ve worked so hard to enjoy. A retirement plan will secure your life post retirement.

Now that you’ve considered your future wants and needs, as well as your retirement goals, it’s time to start planning. The power of starting early: You keep saving until it’s time to.

For instance, say you are currently 32 years old, earn a monthly income of inr 50,000, wish to retire at 60. Key takeaways • retirement planning is the process of examining your income and spending patterns to determine how much you will need to save for. The 50/30/20 rule suggests allocating 50% of income to needs (such as housing, food, and utilities), 30% to wants (entertainment, dining out, hobbies),.

Ask yourself several important questions, such as:. If you’re expecting retirement to leave a big gap in your life, planning new routines, rewards and friendships will boost your sense of optimism and wellbeing. Here’s how you can put your retirement plan into action quickly and efficiently, regardless of your age: