Real Tips About How To Sell Fha Loans

![FHA Loans vs Conventional Loans Pros and Cons [Updated 2017] Fha](https://i.pinimg.com/originals/62/13/47/621347e0f71880010eca9f2e0b9d7b0a.jpg)

Some borrowers want to know because they are interested in buying homes.

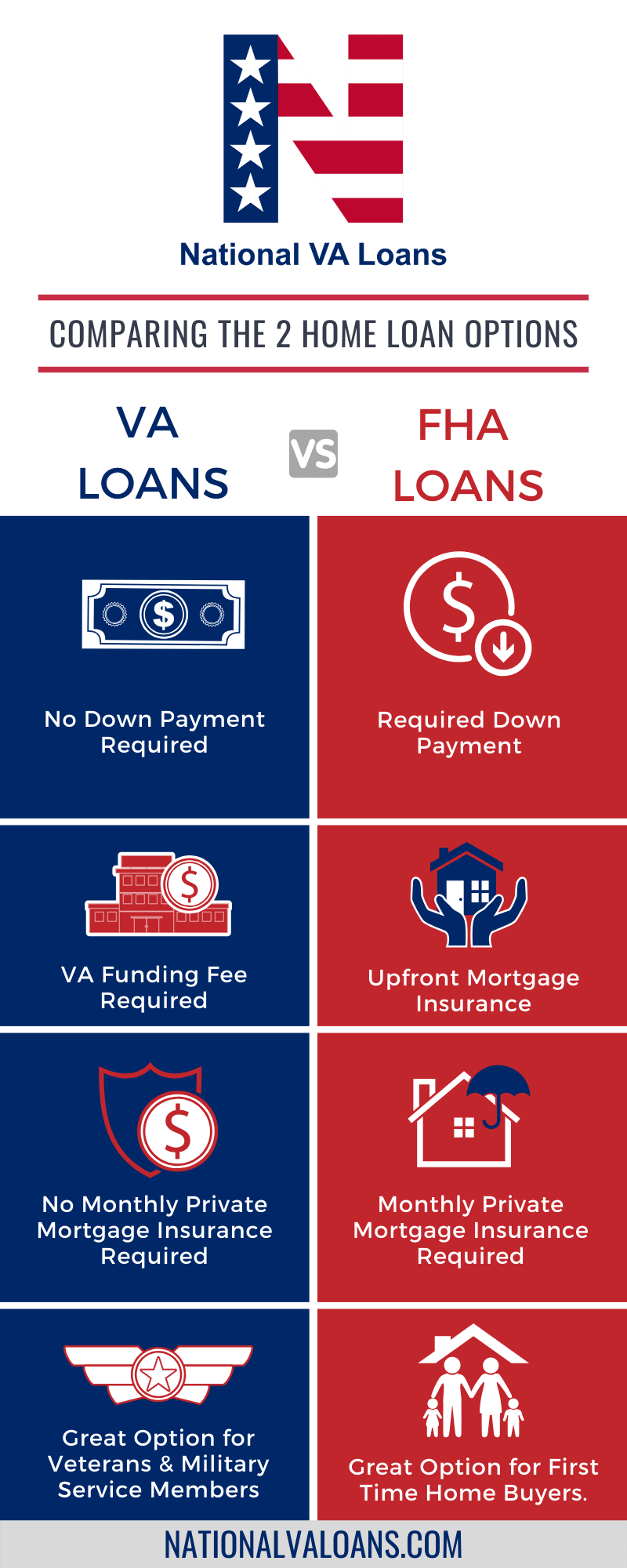

How to sell fha loans. Fha loans come with two term options: The property being purchased with an fha loan must meet all of the minimum property requirementsestablished by hud (the federal department that oversees this program). but aside from that, fha loans don’t affect sellers very much. it’s just another form of financing. Get the financing you need.

July 11, 2023, 10:48 pm utc 5 min what if you could offer the buyer of your home your current mortgage rate? Check out fha requirements, rates, loan size limits, premiums, closing costs and fha pros and. Here is a list of our partners.

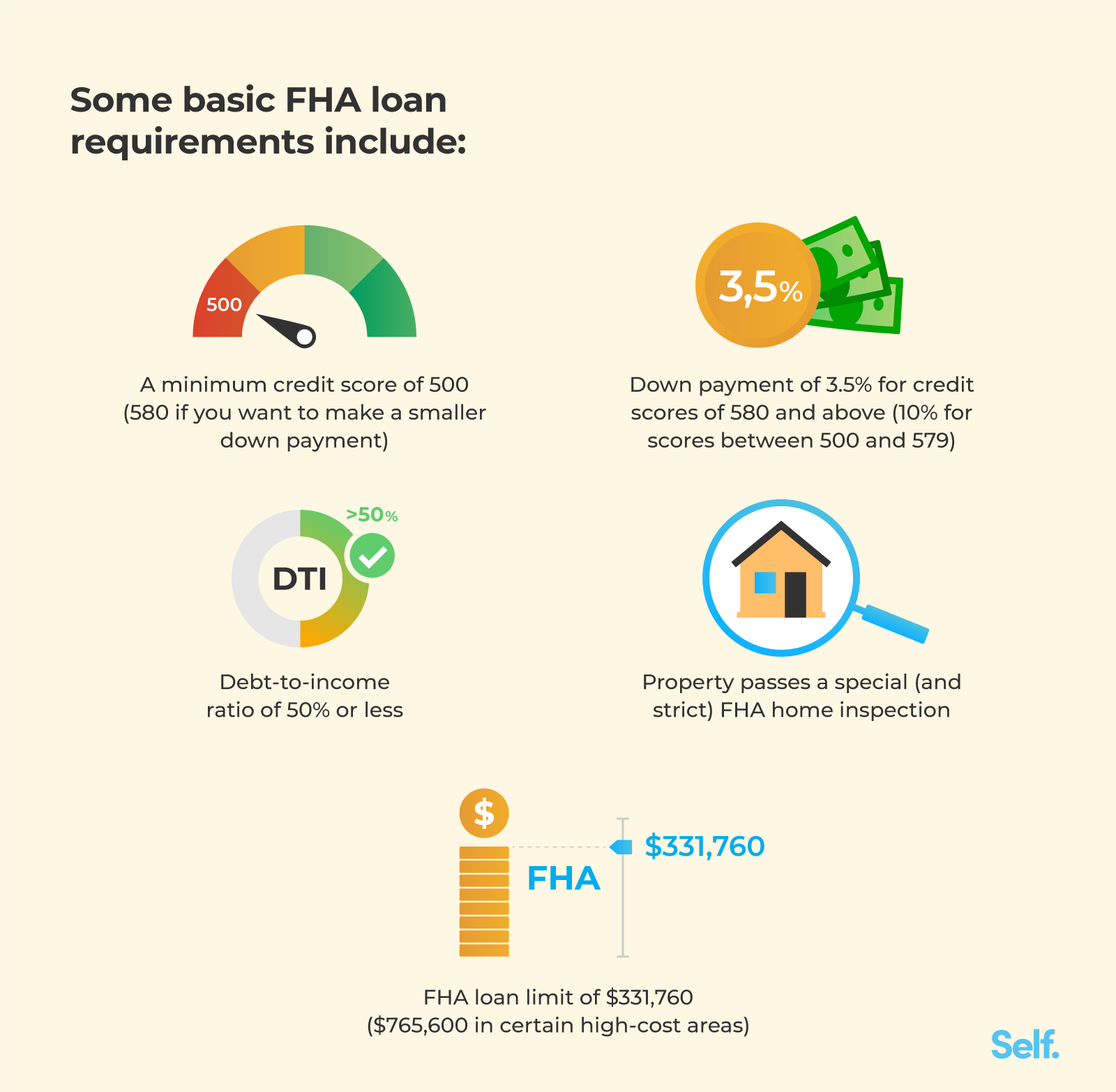

You’ll also pay closing costs for an fha loan, such as appraisal and origination fees. These loans tend to have a bad. The fha will instruct you on any necessary repairs or.

Follow the writers table of contents fha minimum credit score: These include usda, fha, and conventional loans. Learn how to apply for fha loan and get approved.

Everything you need to know about getting a mortgage. June 30, 2023 how long do you have to wait to sell the home purchased with an fha mortgage? Fha loans have been helping people become homeowners since 1934.

A “due on sale” clause states that a lender can require that the full amount of a loan be paid if the. Fha loans are an attractive option for home buyers with a few bumps in their financial. Fha loans are ideal for first time home buyers with 3.5% down.

Most conventional lenders — though not all — require buyers to come up with. Learn more on why sellers often refuse fha loans. Fha loans are assumable because they do not have a “due on sale” clause.

That 3.5% down payment requirement is a big advantage for potential home buyers. Find tips and guides to qualify for a home loan, consider down payment assistance or research refinancing. 500 fha minimum down payment:

What is an fha loan? How do we do it?

![FHA Loans vs Conventional Loans Pros and Cons [Updated 2017] Fha](https://i.pinimg.com/originals/d9/d2/ca/d9d2ca0b8d0874a5e5904806cda04fed.png)

![How Much Is Hesitating To Sell Your [market_city] House Really Costing](https://i.pinimg.com/originals/ae/a0/36/aea036e6e06cde2327d3295cf0cd2da5.jpg)