Fabulous Tips About How To Claim The First Time Homeowners Tax Credit

August 2022 lana dolyna, ea, ctc senior tax advisor one of president biden’s main campaign promises was to help families purchase their first home by.

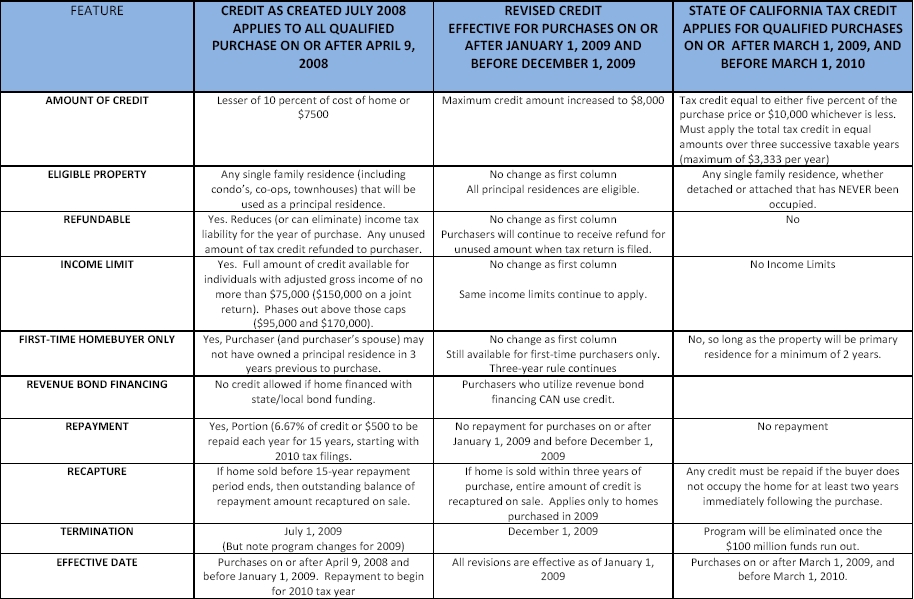

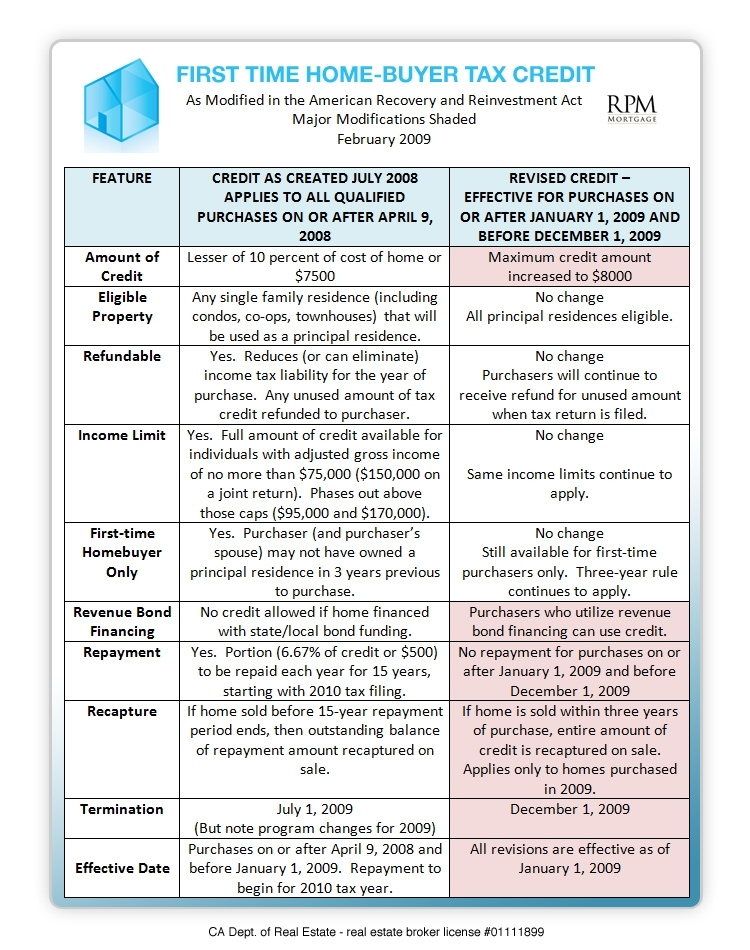

How to claim the first time homeowners tax credit. July 07,2023 table of contents what does the new act mean for buyers? If you or your spouse/common law partner are planning to enter the housing market, you can claim up to $10,000 on your tax return, which would equal up to a $1,500 rebate. Cnn underscored money updated 11:44 am edt, wed january 17, 2024 fizkes/istockphoto on the heels of the 2008 financial crisis, the housing and economic.

And reminder, in the months ahead you’ll be filing for last year’s earnings. The value of the hbtc is calculated by multiplying. The credits are nonrefundable, so you cannot get back more.

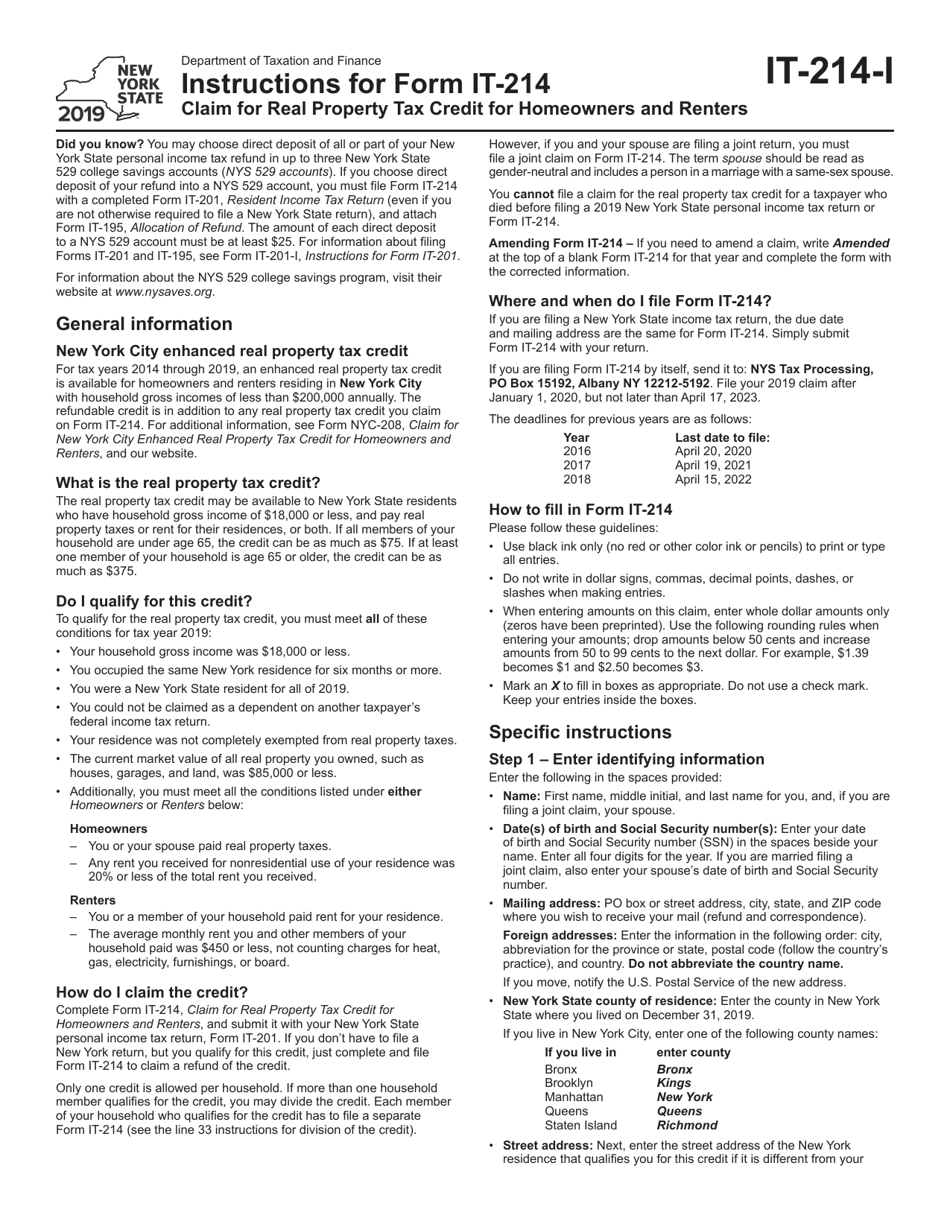

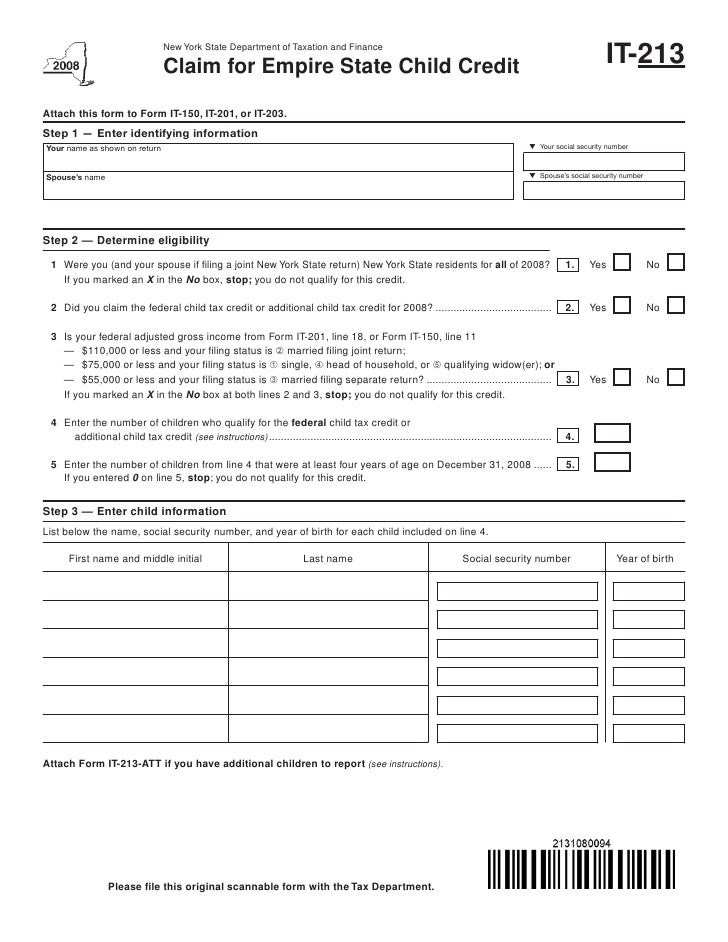

You are eligible for the disability tax credit; You can claim either the energy efficient home improvement credit or the residential energy clean property credit for the year when you make qualifying. Social security number (or your irs individual taxpayer identification number).

The program does apply to any home. Here are the details on the ptc, its eligibility criteria, the pros and cons of choosing the advance premium tax credit (aptc), and the tax forms you’ll need to.