Painstaking Lessons Of Tips About How To Claim Tax In Ireland

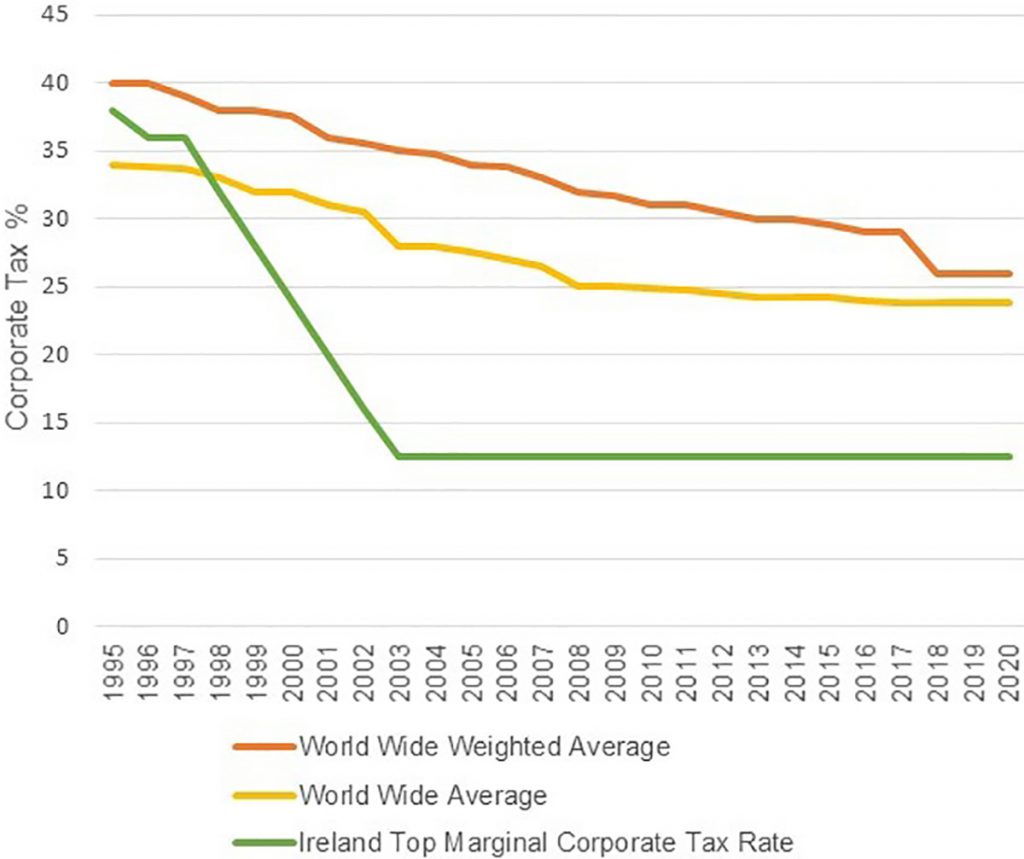

Cutting corporation tax in northern ireland would harm public services, economy minister tells stormont there are no current plans to cut corporation tax in.

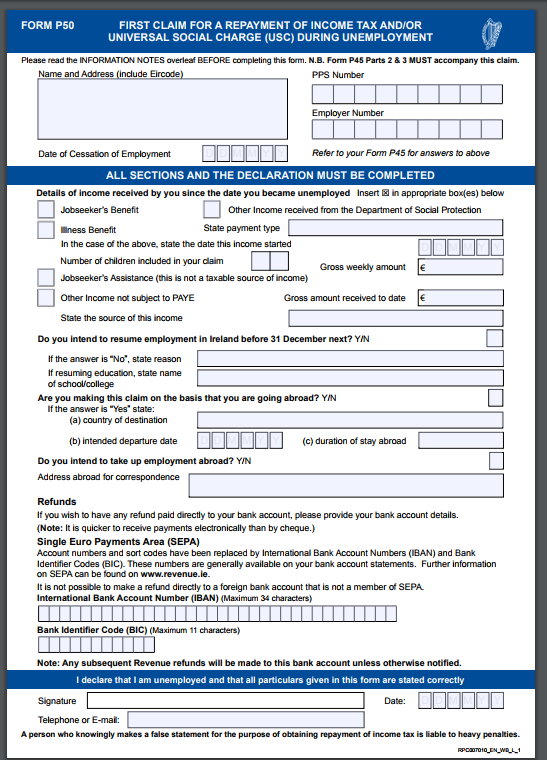

How to claim tax in ireland. Personal tax credits, reliefs and exemptions. Log into paye services within myaccount and select ‘claim unemployment repayment’. What tax can i claim back?

Quick review form our quick review form is the quickest and easiest way to have your taxes. Back in 2022, about 250 people paid tax in ireland at a rate of almost 70 per cent. You must claim a tax refund within the 4 years after the year in which you made the overpayment.

Overview introduction to income tax credits and reliefs tax reliefs reduce the amount of tax that you have to pay. If your preliminary end of year statement shows that you have paid too little tax, you can make a tax return to check how much you owe and whether there are extra tax reliefs. According to revenue, up to 481,000.

To claim a refund: Paye workers can complete an income. Select your favourite newsletters and get the best of irish examiner delivered to your inbox.

We've just been speaking with labour's shadow financial secretary to the treasury, james murray. Unlock the secrets of how to claim tax back in ireland for the first time! We started with the government saying it is considering changing protest rules.

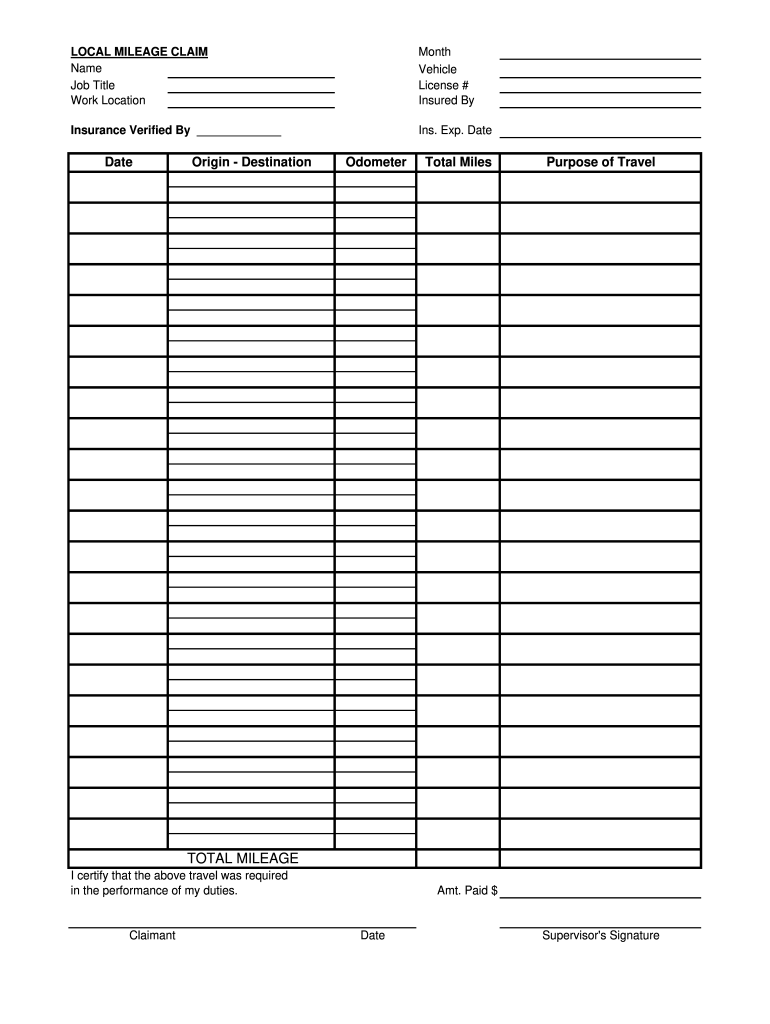

A completed form p50 a. Our comprehensive guide covers everything from eligibility to specific tax relief options. Find out about the different types of income tax relief that apply to.

Starting work, emergency tax, claiming a refund, calculating your tax, understanding entitlements, pensions, being tax compliant. How to claim tax back in ireland home / how it works application options: By petula martyn.

You can use revenue's myaccount service to access paye online services. Anyone paying rent on private rental accommodation is entitled to claim the €500 rent tax credit this month, that was introduced in budget 2023,. You may also be able to claim tax back on tuition fees, dental or medical expenses.

They had managed to create an.