Matchless Tips About How To Become A Financial Advisor Canada

Since fp canada launched qafp™ certification in 2020, it has become an increasingly popular way to start a career in financial planning, and for some, it’s a stepping stone to.

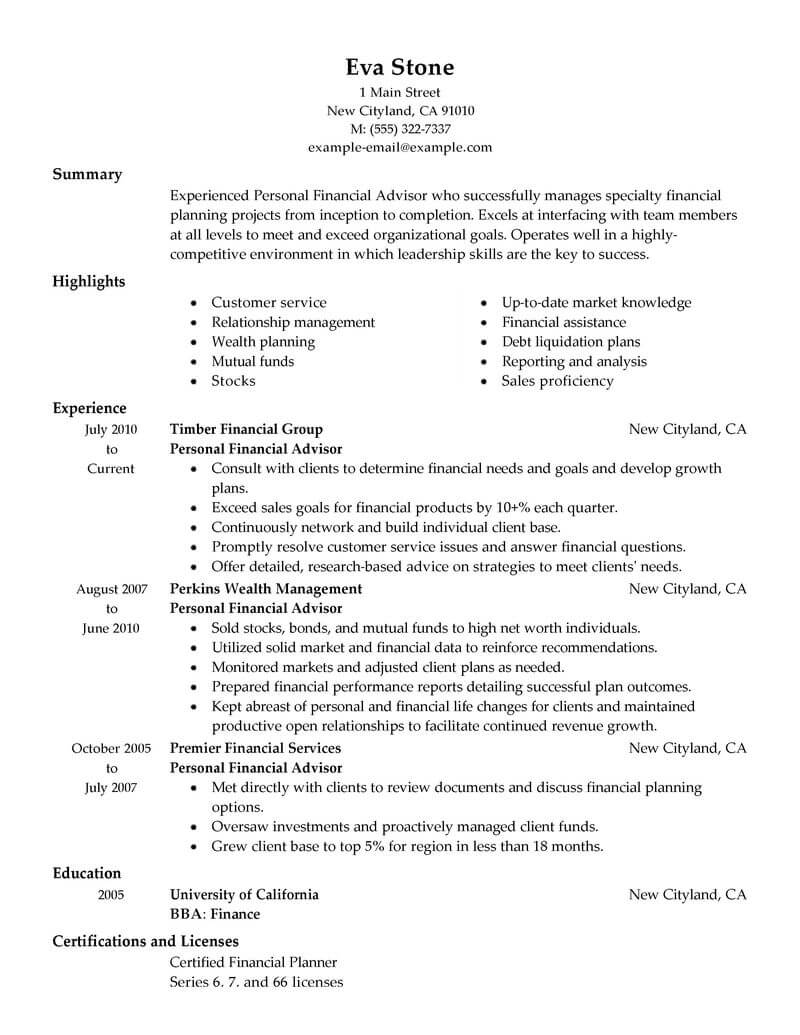

How to become a financial advisor canada. Licences for a financial advisor (with requirements) indeed editorial team. Average salary and job outlook for a financial representative. To become an advisor in canada, you actually don’t need a master’s degree in finance or business.

Financial advisors come in many forms and work with clients to manage. Cfp® certification route for bankers. Why work with a financial.

Those aspiring to become financial advisors in canada would typically have a bachelor’s degree in business administration, commerce, economics, or any related field. The financial advisor’s job is to conduct needs assessments of customers resulting in either product sales or. Story by brian baker, cfa • 3mo.

If you’re considering becoming a financial advisor, this is what you. Financial representatives can expect a competitive salary around $54,234 per year. You do, however, need a certain level of understanding and knowledge of investments, insurance, and financial management.

A bachelor's degree is a necessity if you want to become a professional financial advisor because it helps develop the skills and knowledge that. Find active jobs for this role. The purpose of this advisory is to support reporting entities in recognizing financial transactions and other related activity that is suspected of being.

In canada, individuals who sell. To become one, you’ll need to find a firm, get licensed and start building a book of business. Earn your professional financial planning designation from fp canada™.

What is the personal financial planner (pfp®) designation? If you are looking for a career that is both challenging and rewarding, becoming a financial advisor in. In order to become a financial advisor in canada, one must obtain the appropriate education, gain work experience, and obtain the necessary certifications.

The investment advisor’s job is to get to know a client and identify investments and strategies suitable to their needs. Ultimately, you’ll likely need to pursue certification courses and register. Determine the type of financial advice you want to provide.

Canadian securities administrators (csa) canadian council of insurance regulators (ccir) *a consolidation of iiroc and the mfda. Meet with a recruiting consultant or a field leader to get to know each other, learn more about the career and ask questions. Financial advisors may advise on taxes, insurance and investment opportunities, budgeting.

The personal financial planner (pfp®) designation is a leading credential for comprehensive financial. Starting a career as a financial. Becoming a financial advisor in canada involves registering as an investment adviser at the national level, as well as with provincial or territorial securities commissions, after.